Break free from confusing car finance jargon with our expert advice to help you make the right choice

Navigating car finance doesn't have to be a journey through complex terminology and confusing options. Whether you're buying your first car or upgrading to your dream vehicle, understanding car finance is the key to making the right choice for your circumstances. In this comprehensive guide, we'll walk you through everything from basic car financing options to expert tips that could save you money and help you make a more informed decision.

We know it can feel overwhelming, but don't worry - we'll talk you through everything you need to know in plain English. No confusing jargon, just straightforward advice about getting you behind the wheel of your next car with confidence. Read on to find out more…

What's in This Car Finance Guide?

- The Basics of Car Finance

- Can I Get Car Finance?

- Checks and Applications

- Owning Your Car

- Managing Your Car Finance

- Additional Advice

Key Takeaways:

- Three main car finance options are available: Hire Purchase (HP), Personal Contract Purchase (PCP), and Lease Purchase (LP)

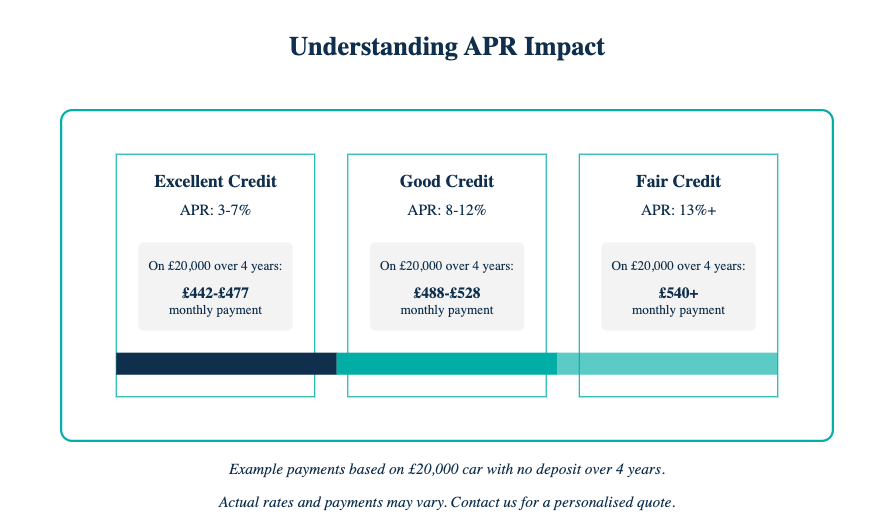

- Your credit score significantly impacts your APR, with rates typically ranging from 3% to 13% or higher

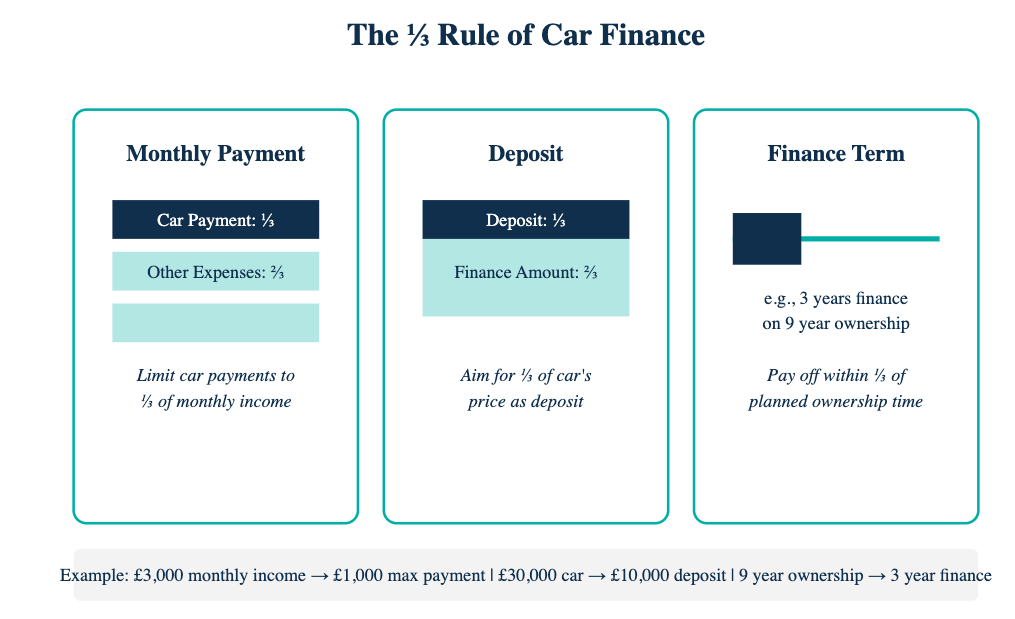

- The ⅓ rule suggests limiting car payments to one-third of your monthly income

- A quick initial approval can take approximately 15-30 minutes, with full approval typically within 1-3 days

- Making regular car finance payments can positively impact your credit score in the long term

- Vehicle ownership depends on your finance type - the finance company typically retains ownership until the final payment with HP

- Professional advice is always recommended before making any major financial commitments - speak to our Octane Finance experts first

The Basics of Car Finance

What are my options for financing a car?

Let's start by breaking down your three main choices for car finance - it’s a good idea to think of them as different roads to the same destination:

Option 1 - Hire Purchase (HP)

Hire Purchase is what we refer to as a "keep it simple" option. HP works by putting down an initial deposit, making monthly payments, and then the car's yours at the end. It's like buying a house with a mortgage - straightforward and clear-cut.

Here's an example:

Let's say you're buying a car worth £20,000 -

- You put down £2,000 as a deposit (the recommended 10% upfront payment)

- Pay £416 a month for 4 years (the agreed contract length)

- After your final payment, the car's all yours!

Option 2 - Personal Contract Purchase (PCP)

Personal Contract Purchase is an ideal choice if you like keeping your options open. Your monthly payments tend to be lower because you're only paying for part of the car's value. At the end, there are three options to choose from:

- You can buy the car by paying the final amount - this is known as a balloon payment

- Hand the car back and walk away (freeing you up to enter another contract)

- Trade the car in for something new and start again

Here's an example:

On that same £20,000 car you’re buying -

- You put down a £2,000 deposit (10% of the car’s value)

- Make lower payments of around £275 a month for 4 years (contract length)

- Then either pay the £8,000 balloon payment (the remaining amount) to keep it or hand it back to the lender with nothing else to pay

Option 3 - Lease Purchase (LP)

Lease Purchase is best explained as a mix between leasing and buying a car. You'll need to make a final payment at the end of the contract, but it's a great option if you're planning to keep the car.

Who will my car finance actually be with?

This is a good question and one you should always ask to be absolutely sure. For example, while you might be choosing your car at a dealership, your finance agreement is actually with a finance company - also known as a lender. Think of the dealer as the matchmaker - they introduce you to the lender, but your ongoing relationship (and your monthly payments) will be directly with the finance company.

The same goes with a broker such as ourselves here at Octane Finance. We match car buyers with lenders all over the UK to find them the perfect finance solutions. Once you’ve signed on the dotted line, you’ll liaise with the finance company directly throughout the duration of your contract.

What's this APR thing all about?

APR (which stands for Annual Percentage Rate) is basically the cost of borrowing money, shown as a yearly percentage. The higher the number, the more you'll pay. Think of it like this: if you borrow £100 at 10% APR, you'll pay back £110 over the year.

The APR rate you can access will depend on your current credit score:

- If you have excellent credit, you might get rates as low as 3 to 7% APR

- If you have good credit, you could expect around 8 to 12% APR

- If your credit score is not-so-great, you might be looking at 13% APR or higher

What's this '⅓ rule' everyone talks about?

Here's a straightforward way to think about it:

- Don't spend more than ⅓ of your monthly income on car payments

- Try to put down ⅓ as a deposit if you can

- Plan to pay off the finance within ⅓ of the time you'll keep the car

Here’s an example:

If you earn £3,000 a month -

- Aim to keep car payments under £1,000

- On a £30,000 car, try to put down £10,000

- If you'll keep it for 9 years, aim to pay it off in 3

Can I Get Car Finance?

Will I be accepted for car finance?

In our experience, there's no guaranteed yes or no until you apply, but here's what lenders will look at to see if you match their criteria:

- Are you 18 or over? (That's a must!)

- Do you have a regular income?

- How's your credit history looking? (This is where your credit score comes in)

- Are you on the electoral roll?

- Think of the process much like filling out a job application - the better prepared you are, the better your chances of success! (Or at least, getting to the next round!)

How long does car finance take to get approved?

Most lenders try not to keep you waiting too long - here’s what typically happens:

- A quick initial check usually takes about 15 to 30 minutes

- A first approval usually takes a couple of hours

- Full approval can take 1 to 3 days

- Finalising the contract can take up to a week

Is it easy to get car finance?

Well, it's not as hard as climbing Mount Everest, but it's not quite as easy as ordering a pizza! Your chances of securing car finance are better if you:

- Have a steady job

- Can put down a decent deposit

- Choose a car that suits your budget

- Have a good track record with money

Checks and Applications, and Credit History

What will they check when I apply for car finance?

Despite initial worries from customers, lenders aren't trying to snoop on your spending habits! They just need to make sure you can comfortably afford the monthly repayments over a designated period of time. As part of the process, finance companies will look at:

- Your identity (making sure you are who you say you are)

- Where you live

- Your income and outgoings

- Your credit history (and current credit score)

- The car you're interested in

Will applying for car finance affect my credit score?

So let’s be real here. In short, there will be a small dip when a lender initially checks your credit history. However, making your payments on time can actually boost your credit score in the long run. Think of it like going to the gym - there might be some initial soreness, but you'll be stronger in the end!

Owning Your Car

Who actually owns the car while I'm paying for it?

This is one of the most common questions we get asked and it all depends on the type of car finance you apply for…

With Hire Purchase Finance:

The finance company owns the car until your final payment - like having a really long IOU note. Once you make that last payment, it's all yours!

With Personal Contract Purchase Finance:

The finance company owns the car throughout the contract. You're like a long-term caretaker with the option to buy at the end.

With Lease Purchase Finance:

The finance company owns the car until you've made all payments, including the final payment at the end of the agreement. Once you've made all payments, ownership transfers to you. This is similar to Hire Purchase but with a larger final payment structure like PCP.

Can I sell the car if it's on finance?

The short answer is: yes, but there's a process to follow. You can't just sell the car like you would if it was your own. You'll need to either:

- Pay off the outstanding finance first (then sell)

- Get the dealer to help settle the finance (through a part-exchange process)

- Transfer the finance (though this can be tricky to do)

Managing Your Car Finance

Set yourself up for success:

- Create a dedicated monthly budget that includes your car payment, insurance, and maintenance costs

- Set up automatic payments to ensure you never miss a due date

- Choose a payment date that aligns with your payday

- Keep a small emergency fund for unexpected car-related expenses

- Download your finance company's app (if available) for easy payment tracking

Money-saving tips:

- Consider paying a little extra money each month to reduce your overall interest

- Look into overpayment options (but check for any early repayment charges first)

- Take advantage of any annual payment reviews offered by your finance company

- Keep an eye out for better interest rates – you might be able to refinance after making consistent payments

Warning signs to watch out for:

While you no doubt have the best intentions to meet all the terms of the car finance contract, your personal circumstances may suddenly change unexpectedly. To give you some examples, if you're experiencing any of the situations below, we recommend you contact your finance company immediately:

- Struggling to make your monthly repayments

- Unexpected changes to your income

- Large upcoming expenses that might affect your car payments

- Changes to your employment status

Building a positive payment history

Making regular, on-time payments can help improve your credit score. You can make the most of your car finance by following these 5 tips:

- Set yourself calendar reminders for payment due dates

- Keep copies of all payments and correspondence on file

- Review your monthly statements for accuracy

- Track your credit score to see the positive impact

- Request an annual statement of payments made

What to do if you're struggling to make payments

We understand that circumstances can change and these may be out of your control. If you're having difficulty with payments, always ACT EARLY. Do so by contacting your finance company as soon as possible and have your account details ready so the person answering the phone can find your file.

Be honest about your situation so the lender can talk you through the options. It may be that a payment holiday is available, and your agreement can be restructured. Then there’s the opportunity for a temporary payment reduction or the possibility of refinancing your car. Free advice is accessible online and from dedicated financial advice charities.

Planning for the future

Before your existing contract finishes, think ahead to make your car finance work better for you and ensure it still meets your needs:

- Start planning for your next car early to secure the best deals

- Keep maintenance records to protect your current car's value

- Consider purchasing GAP insurance if you have a new vehicle

- Stay informed about market rates and new finance options

Additional Advice

5 Common Car Finance Pitfalls to Avoid:

- Not reading the fine print about early repayment charges

- Focusing only on monthly payments rather than total cost

- Forgetting to factor in insurance and maintenance costs

- Not shopping around for the best finance rates

- Overlooking the importance of GAP insurance for new vehicles

Pre-Application Checklist

Before applying for car finance, ensure you have:

- Three months of bank statements

- Proof of address (utility bill or council tax statement)

- Valid photo ID (driving licence or passport)

- Employment details and proof of income

- Details of your current address for the last three years

- Information about your desired vehicle

After Your Finance is Approved

Once you've secured your car finance:

- Keep all documentation in a safe place

- Set up a direct debit for payments

- Mark payment dates in your calendar

- Consider setting aside an emergency fund for repairs

- Review your insurance options carefully

Ask Our Experts About Financing Your Car

At Octane Finance, we're not just here to arrange your car finance - we're here to make sure you get the best deal possible for your circumstances. We've helped thousands of drivers across the UK find their perfect car finance solution, and we'd love to help you too!

What Makes Us Different?

- We’re real people!

- No chatbots or automated responses

- Direct access to experienced finance specialists

- UK-based team who understand your needs

- Expert knowledge

- Strong relationships with multiple lenders

- Solutions matched to your specific circumstances

- Options for all credit histories

Whether you're looking for your first car finance deal, want to upgrade your current vehicle, are dealing with less-than-perfect credit, are self-employed or in a unique situation, or are just exploring your options, our team is here to help! Get in touch today.