Will a Car Dealer Settle My Finance?

Your complete guide to selling a financed car through a dealer

Selling a car that's still under finance can seem daunting, but it's a common situation that dealers handle regularly. Most car dealers will settle your outstanding finance as part of the purchasing process to make selling or part-exchanging your vehicle as convenient as possible.

However, there are important factors to consider, such as whether you're in positive or negative equity, and what terms your current finance agreement includes. Car dealers handle finance settlements regularly, so they’ll be able to work directly with your finance company to clear the outstanding balance, ensuring a smooth transition of ownership.

Whether you're looking to upgrade your vehicle or simply want to sell, understanding how to navigate the process of selling a financed car is crucial. This guide will walk you through everything you need to know about selling a financed car through a dealer. Read on to find out more…

Key Takeaways:

- Dealers can settle your existing car finance as part of the sale process

- Understanding your settlement figure and equity status is essential before selling

- Early termination fees may apply when settling car finance early

- Different options are available depending on whether you have positive or negative equity

- Always ensure you obtain written confirmation of car finance settlement from your lender first

Selling a Financed Vehicle: Your Options

When selling a car under finance, you have several options available. Many dealers will handle the settlement process as part of the transaction, making it a convenient option for sellers. However, you'll need to understand your current financial position and ensure all parties involved communicate effectively throughout the process.

The most straightforward approach is to sell your car to a dealer who will settle your existing finance directly with the lender. This route eliminates the need for you to find the funds to settle the finance yourself. Alternatively, you could pay the finance independently before selling, though this option requires having the funds available upfront.

Understanding Your Finance Agreement

Before going ahead with the sale of your vehicle, it's vital to review your finance agreement thoroughly. Different types of car finance come with varying terms and conditions regarding early settlement - for example:

- Personal Contract Purchase (PCP) finance may have specific, or more restrictive, conditions for early termination

- Hire Purchase (HP) finance is usually more straightforward to settle early with the lender

We always recommend you to contact your finance provider first to understand any specific requirements or restrictions in your agreement. They can provide your settlement figure and explain any early termination fees that might apply before selling your car.

Positive vs. Negative Equity: What's the Difference?

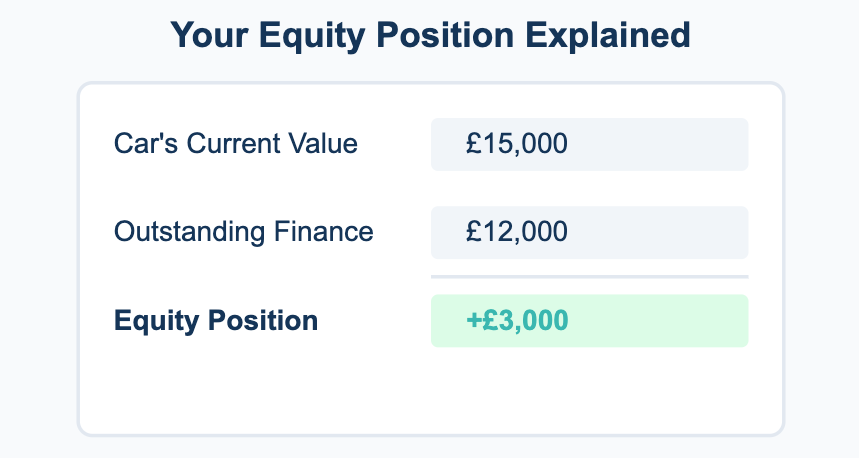

Before selling a car with outstanding finance, you’ll need to know whether you're in positive or negative equity, as this can significantly impact your options. Your equity simply refers to the difference between your car's current market value and the amount you still owe on your finance agreement.

As you can appreciate, this figure will determine your next steps and could affect how much money you'll need to complete the sale process. Below we explain the difference between positive and negative equity:

Positive Equity

When your car is worth more than the remaining finance balance, this is what’s referred to as positive equity. The good news is that if you’re in this position, the surplus can be used as a deposit on your next vehicle or pocketed as cash. For example, if your car is worth £15,000 and your settlement figure is £12,000, you have £3,000 in positive equity.

Negative Equity

If you owe more than your car's current value, you're in what’s called negative equity, and this isn’t necessarily a good position to be in. For instance, if your settlement figure is £15,000 but your car is only worth £12,000, you have £3,000 of negative equity that needs to be addressed as part of the sale.

Settling Your Car Finance: What You Need to Know

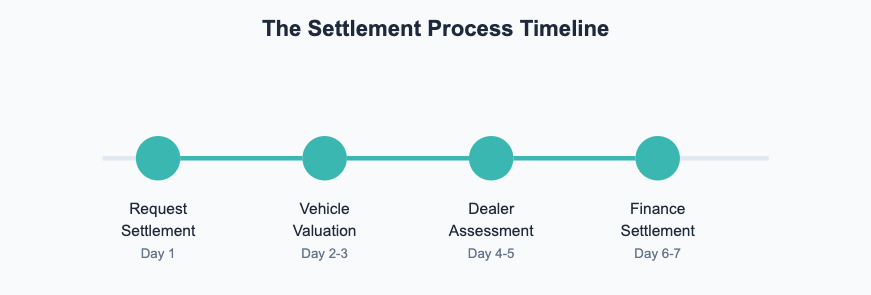

The journey from deciding to settle your car finance to completing the final transaction follows several key steps. To give you a better idea of what to expect, this section will walk you through each stage of the settlement process, ensuring you know exactly what happens when, who's responsible for what, and how to protect your interests along the way.

Whether you're settling through a dealer or managing the process yourself, understanding this process is essential for a successful finance settlement that ticks all the right boxes. The car finance settlement process typically follows these steps:

- Contact your finance company for an up-to-date settlement figure

- Get a valuation for your vehicle

- Compare the settlement figure to your car's value to understand your equity position

- Discuss settlement options with the dealer

- Ensure all paperwork is completed correctly

- Ask for written confirmation once the finance is settled

If you plan on selling your car to a dealer, they will usually be happy to contact your finance company directly and offer to pay off the outstanding finance. If you’re in positive equity, they will either pay you any excess you’re owed or give you the option to offset it against the cost of a new vehicle. Be aware that if you’re in negative equity, you’ll be required to cover the shortfall before any transaction can be completed.

It’s worth knowing that the settlement figure provided by your finance company is typically only valid for a specific amount of time, usually 7-14 days. If the sale process extends beyond this period, you'll likely need to request an updated figure, which could differ from the first.

Frequently Asked Questions:

We hope our guide to selling a financed car through a dealer has proved a useful read. As you can imagine, we often get asked questions relating to settling vehicle finance, so in this section, we’ve shared some of our most commonly asked ones:

Q: How long does it take for finance to clear on a car?

A: Once a settlement payment has been made, it typically takes 1-3 working days for the finance to clear and be marked as settled. However, the exact timeframe can vary depending on your finance provider and the payment method used. For your peace of mind, we recommend you always request written confirmation from your finance company once the settlement has been processed.

Q: Can you negotiate a car finance settlement figure?

A: While the basic settlement figure is usually non-negotiable as it represents the remaining balance plus interest, there may be room to negotiate early termination fees or other administrative charges. Contact your finance provider directly to discuss your options. Some lenders may be willing to reduce or waive certain fees, particularly if you're experiencing financial difficulties, so we encourage you to be open about your circumstances.

Q: Can car finance be approved and then declined?

A: Yes, in some cases, car finance can be provisionally approved but later declined during final checks. This usually happens when:

The lender discovers additional information during detailed credit checks

The documentation provided by you doesn't match the initial application

There are discrepancies in employment or income verification

To avoid this situation, we recommend you always be completely honest and accurate with your initial application.

Q: Can I give my car back halfway through finance?

A: Most finance agreements include voluntary termination rights, typically once you've paid 50% of the total amount payable. This is known as your Section 75 rights under the Consumer Credit Act. However, there are some clauses to be aware of:

You must ensure the car is in good condition

Mileage must be within reasonable limits

Any damage beyond normal wear and tear may incur charges

This option may affect your credit score

Q: What happens if I miss payments on my car finance?

A: Missing payments can have serious consequences. It will in most cases, negatively impact your credit score and you may be charged with late payment fees on top of what you already owe. Worse still, the finance company could take legal action and your vehicle may be repossessed. If you're struggling with payments, contact your lender immediately to discuss payment plans or alternative arrangements.

Q: Can I sell my car with outstanding finance if I'm in arrears?

A: While it's possible to sell a car with outstanding finance even if you're in arrears, it does prove more complicated. You'll need to settle any missed payments and the lender may require full settlement immediately. As such, we advise you to always be transparent with both the dealer and your finance company about your situation.

Q: Is it better to settle car finance early or continue with payments?

A: The answer to this question depends entirely on your individual circumstances. While early settlement could save you money on interest in the short term, be aware that some agreements have early repayment charges which may actually offset any savings you may make. We recommend you calculate the total cost of both options before making a decision either way and it’s worth speaking to your lender to check if there are any payment holiday options which may help if money is temporarily tight.

Get Expert Support with Octane Finance

At Octane Finance, we understand that managing car finance can be complex. That's why we're here to help you navigate every step of your car finance journey, whether you're looking to settle existing finance, sell your vehicle, or explore new finance options.

While we’re a broker and not a lender, we can still offer you expert guidance on settling your existing car finance and source competitive rates on new car finance packages. We pride ourselves on making car finance simple and accessible for everyone. With years of experience in the automotive finance industry, we've helped thousands of customers across the UK successfully manage their car finance needs.

Ready to Take the Next Step?

Don't let car finance complications hold you back. Contact us today to discuss your options. Whether you're looking to settle the finance on your current car, upgrade your vehicle, or start a new agreement, we're here to pair you with your perfect lender.