No Claims Bonus Explained

A Complete Guide to Saving on Your Car Insurance

If you're looking to save money on your car insurance (and let's face it, who isn't?), understanding your No Claims Bonus (NCB) could be your ticket to significant savings. Whether you're a new driver or a seasoned motorist, this comprehensive guide will explain everything you need to know about this valuable insurance benefit.

Key Takeaways:

- No Claims Bonus (NCB) or No Claims Discount (NCD) rewards safe driving with insurance premium discounts of up to 75% after 5 years.

- The typical NCB discount structure is as follows:

- 1 year: 30% off

- 2 years: 40% off

- 3 years: 50% off

- 4 years: 60% off

- 5+ years: Up to 75% off - NCB Protection is optional and allows you to maintain your discount even after making claims (usually up to 2 claims in 3 years).

- Without protection, making an at-fault claim typically resets your NCB to zero.

- You can keep your NCB for up to 2 years without having insurance or a car.

- NCB is transferable between insurance providers – just request proof from your current insurer.

- You can only use your NCB on one policy at a time, and it applies per policyholder, not per vehicle.

- Named drivers typically don't build up their own NCB.

- Making small claims might not be cost-effective – sometimes paying for minor repairs yourself can save money long-term.

- Different insurers have different NCB policies, so always check the specific terms and conditions.

What is a No Claims Bonus? No Claims Bonus Meaning:

A No Claims Bonus (NCB) is essentially a reward for being a careful driver. This means that for every year you drive without making an insurance claim, you earn a discount on your car insurance premium – it's that simple. Think of it as a "thank you" from your insurer for not costing them any money in claims.

This discount increases each year you stay claim-free, potentially saving you up to 75% on your insurance premium after five years. For example, if your base insurance premium is £1,000, a maximum No Claims Bonus could reduce this to as little as £250.

In fact, it’s one of the most valuable ways to save money on your car insurance, which is why protecting it is often worth considering.

Are No Claims Bonus and No Claims Discount the Same Thing?

Yes, No Claims Bonus (NCB) and No Claims Discount (NCD) are exactly the same thing – they're just different names for the same insurance benefit. Insurance providers use these terms interchangeably, and you might also see variations like:

- No Claims History

- No Claims Entitlement

- Claims Free Years

- Claims Free Discount

Think of it like this: The word "Bonus" emphasises that it's a reward for safe driving, whereas the term "Discount" focuses on the money you're saving. The important thing to remember is that whether your insurer calls it NCB or NCD, they're referring to the same discount you earn for each year of claims-free driving.

Don't be confused if you see different terms used across various insurance websites or documents – they all refer to the same benefit that can save you up to 75% on your car insurance premiums.

How Does a No Claims Bonus Work?

Your No Claims Bonus builds up one year at a time, typically following this pattern:

- 1 year: 30% discount

- 2 years: 40% discount

- 3 years: 50% discount

- 4 years: 60% discount

- 5+ years: Up to 75% discount

Remember that these percentages are typical examples, and actual discounts may vary between insurance providers.

Protecting Your No Claims Bonus: Is It Worth It?

Insurance providers offer No Claims Bonus protection as an additional feature on your policy. While it costs extra, it can be worth considering, especially if you've built up several years of no claims.

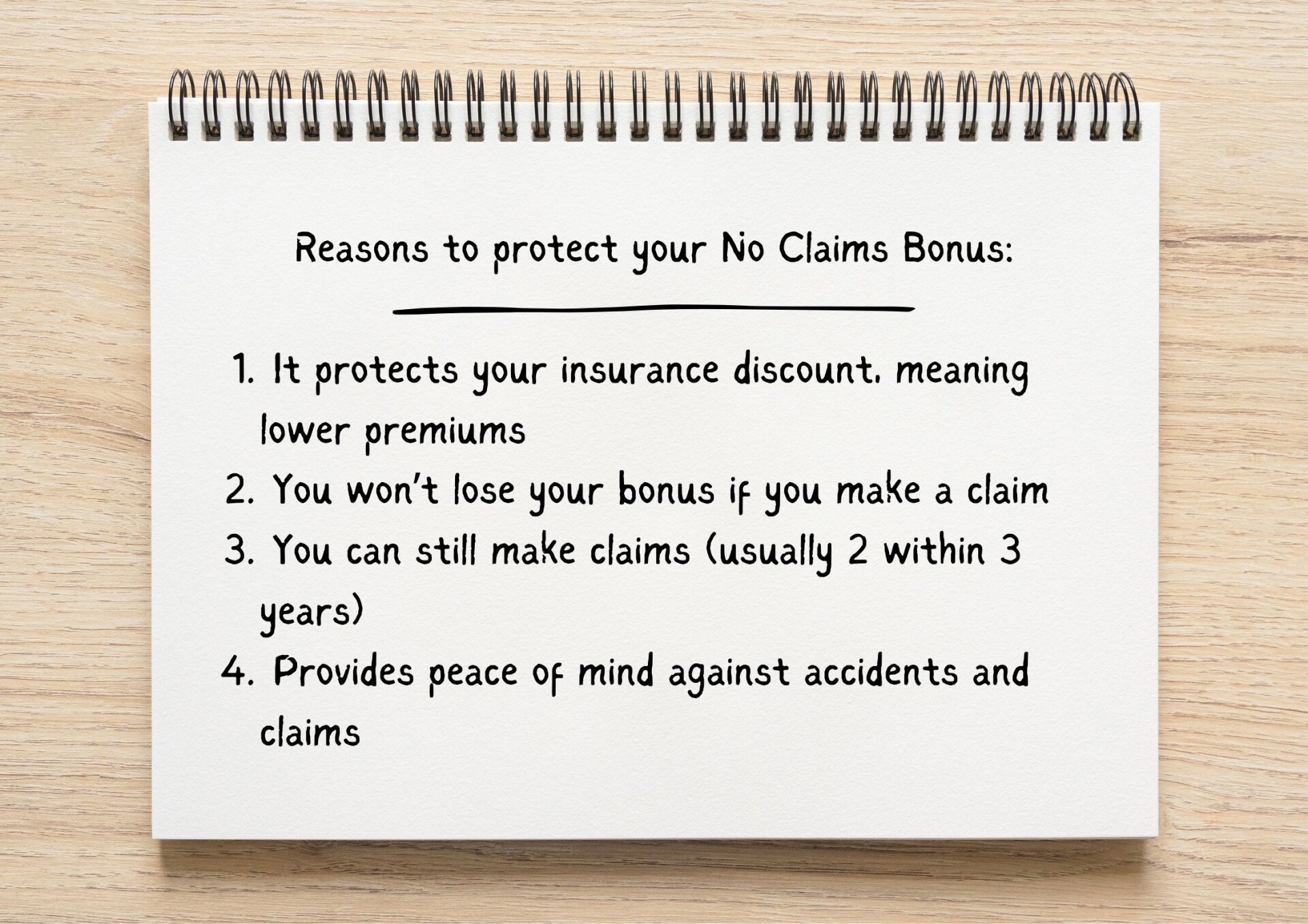

Why Protect Your NCB?

Think of No Claims Bonus protection as insurance for your insurance discount. Without protection, a single claim could reset your NCB to zero, potentially increasing your premium significantly at renewal. With protection, you can make a certain number of claims (usually two within three years) without losing your discount.

However, it's important to understand that a protected NCB doesn't prevent your premium from increasing after a claim. It's also worth noting that the cost of protection varies between insurers.

How to Protect Your No Claims Discount:

Protecting your No Claims Discount is a smart choice, especially if you've built up several years of claims-free driving. Here's our step-by-step guide to securing your valuable discount:

Step 1: Check Your Eligibility

- Most insurers require a minimum of 3 to 4 years of NCB before offering protection.

- You'll need a clean driving licence with no recent claims.

- Some insurers may have age restrictions or other qualifying criteria.

Step 2: Choose Your Protection Level

There are several options available when it comes to protecting your No Claims Bonus - typically these are a standard level of protection and a guaranteed level of protection. The difference between the two is the amount of claims allowed per year.

Step 3: Compare Protection Costs

We recommend that you get quotes from multiple insurers as protection costs vary significantly, then calculate the cost-benefit ratio. Do this by comparing the protection cost against potential premium increases and consider your NCB years and maximum discount level.

Step 4: Always Read the Small Print!

We know reading all the terms and conditions can be boring, but it’s well worth your while. Important details to check include:

- Maximum number of claims allowed

- Time period the protection covers

- What types of claims are covered

- Any exclusions or special conditions

- Impact on future premiums

Step 5: Add Protection to Your Policy

You can add NCB protection when taking out a new policy, at renewal times with your existing provider, and sometimes mid-policy (though this may incur additional fees).

Step 6: Maintain Your Protection

To keep your NCB protection valid, always make sure you pay premiums on time, report any incidents promptly, update your insurer about any changes in circumstances, and finally, follow all policy conditions.

Cost Considerations

No Claims Discount Protection typically costs between £50-£100 annually. If you’re not sure these costs are worth it, consider the following points first:

- The more NCB years you have, the more valuable protection becomes.

- Protection cost usually increases with the number of NCB years.

- Some insurers automatically include NCB protection in premium packages.

- For peace of mind, the cost might be worth it even if you don't claim.

Our table below outlines when NCB makes the most sense, compared to when protection might not be worth it:

| Consider Protecting Your NCB if: | Consider Skipping NCB Protection if: |

| You have 4+ years of no claims | You have fewer than 3 years of NCB |

| You rely on your low premium to afford insurance | The protection cost is more than 10% of your premium |

| You live in a high-risk area for accidents or theft | You have alternative insurance options |

| You do high annual mileage | You rarely drive or have very low annual mileage |

| You can't afford a significant premium increase |

Remember that protecting your No Claims Bonus doesn't stop premiums from rising after a claim – it just preserves your discount percentage. Your base premium can still increase following a claim, but having your NCB protected means you'll still receive your earned discount on that higher base premium.

What Happens if I Don't Protect My No Claims Bonus?

Not protecting your No Claims Bonus means you're taking a calculated risk with your insurance discount. While you'll save money on protection costs, you could face significant premium increases if you need to make a claim. Without protection, making a claim typically affects your NCB in these ways…

At-Fault Accidents:

- Your NCB could drop to zero

- Lose your entire discount immediately

- May take several years to rebuild

- Premium could increase significantly

Non-Fault Accident:

- NCB might be affected even if the accident wasn't your fault

- Could lose years of discount if another party isn't identified

- May keep NCB if insurer recovers all costs

Multiple Claims:

- The second claim within one year could reset NCB to zero

- Harder to find competitive quotes with multiple claims

- May face restricted coverage options

Remember that even minor incidents can lead to claims that affect your NCB. Weigh the annual cost of protection against the potential long-term financial impact of losing your discount.

What Happens if You Make a Claim?

Without protection, making a claim typically affects your No Claims Bonus in the following three ways:

- At-fault claim: You'll lose some or all of your NCB

- Non-fault claim: Your NCB usually remains intact if your insurer recovers all costs

- Split liability: You might lose a portion of your NCB

Keeping Your No Claims Bonus Without a Car

Are you planning to take a break from driving? You can typically keep your No Claims Bonus for up to two years without insurance. However, you'll need to:

- Get proof of your NCB from your last insurer

- Check with potential future insurers about their specific policies

- Be aware that some insurers may reduce your NCB after a break

Transferring Your No Claims Bonus

If you’re switching car insurers then the good news is that your No Claims Bonus can move with you! Here's how:

- Request proof of your NCB from your current insurer

- Submit this proof to your new insurer within their specified timeframe (usually 14 to 21 days)

- Keep copies of all documentation

Important Facts to Remember:

- NCB is calculated per policyholder, not per car

- You can only use your NCB on one policy at a time

- Some insurers offer accelerated NCB schemes for new drivers

- Named drivers typically don't build up their own NCB

- Multi-car policies might have different NCB rules

How to Get Proof of Your No Claims Bonus:

- Request it from your insurer when your policy ends

- Check your renewal documents

- Contact your insurance provider directly

- Look for it in your cancellation documents if switching providers

Frequently Asked Questions

Q: How do I check my no claims bonus?

A: Your current NCB years should be listed on your insurance renewal documents. You can also contact your insurer directly to request proof of your NCB, which they'll typically provide within 14 days.

Q: How do I transfer my no claims bonus?

A: Request proof of your NCB from your current insurer when your policy ends. Submit this proof to your new insurer within their specified timeframe (usually 14 to 21 days). Most insurers accept electronic copies, but keep the original documents safe.

Q: Can you keep your no claims bonus without a car?

A: Yes, most insurers will honour your NCB for up to two years after your policy ends. However, some may reduce the number of years if there's a gap in your insurance coverage. Always check specific provider policies.

Q: Can named drivers build up a no claims discount?

A: Generally, no. NCB is typically only earned by the main policyholder. However, some insurers offer specific "named driver no claims discount" schemes - check with individual providers about their policies.

Q: Can I transfer the no claims discount from driving a company car?

A: Some insurers will accept company car NCB if you can provide written proof from your employer or the company's insurer. This often needs to confirm you were the main driver and your claims history.

Q: How much could my no claims bonus save me?

A: NCB can reduce your premium by up to 75% after five years of claims-free driving. For example, a £1,000 premium could drop to £250 with maximum NCB, though actual savings vary between insurers.

Q: How do I know how much no claims bonus I have?

A: Check your insurance renewal documents or policy schedule, which should state your current NCB years. You can also contact your insurer directly for confirmation.

Q: Can I use my no claims bonus on a second car?

A: No, you can only use your NCB on one policy at a time. However, some insurers offer "mirrored" NCB for second cars or multi-car policies with specific terms.

Q: Can I transfer my no claims bonus to another person?

A: No, NCB is non-transferable between people as it's linked to individual driving history. This includes spouses and family members - each driver must build their own NCB.

Q: Is the no claims bonus capped?

A: Most insurers cap the maximum NCB discount at five years (offering 60-75% discount). Some specialist insurers might recognise up to nine or even 15 years, but the additional discount is usually minimal beyond five years.

Did You Find Our Guide Useful?

We're committed to helping you make informed decisions about your car ownership. If you found this guide about No Claims Bonus useful, you'll love our other comprehensive resources right here on the Octane Finance website.

Dive into our extensive library of car finance guides covering topics such as car finance basics, PCP and HP agreements, credit score guides, vehicle running costs, insurance tips, and money-saving advice. Visit our blog section to discover more expert guides and tips for managing your car finance needs.