What is Guaranteed Future Value (GFV)?

Our comprehensive guide explains everything you need to know about GFV car finance

When exploring car finance options in the UK, you may come across the term Guaranteed Future Value (GFV). This plays a crucial role in certain types of car finance agreements, particularly Personal Contract Purchase (PCP) deals.

Understanding GFV can help you make informed decisions about your car finance options and potentially save money in the long run. In this comprehensive guide, we'll explain what Guaranteed Future Value is, how it works, and its implications for car buyers. Read on to find out more…

Key Takeaways:

- GFV is a predetermined value of a car at the end of a finance agreement, typically used in PCP deals.

- It provides flexibility at the end of the agreement: buy the car, return it, or trade it in.

- GFV is calculated based on factors like the car's make, model, anticipated mileage, and projected depreciation.

- Understanding GFV can help you make informed decisions about car financing and ownership.

- GFV can affect monthly payments and your options at the end of the agreement.

Guaranteed Future Value Explained: What it’s For and How it Works

Guaranteed Future Value, often abbreviated as GFV, is a predetermined amount that a finance company predicts a car will be worth at the end of a finance agreement. This concept is most commonly associated with Personal Contract Purchase (PCP) agreements - a popular choice for many.

The GFV represents the minimum value the finance company expects the car to be worth when your agreement ends. It's sometimes also referred to as the "balloon payment" because it's a larger sum left to pay at the end of the agreement if you choose to keep the car.

How Does GFV Work in Car Finance?

Using a PCP agreement as an example, your monthly payments are calculated based on the difference between the car's initial purchase price and its Guaranteed Future Value, plus interest. Here's a simplified break down of how it works based on the following:

- Initial car value: £30,000

- Guaranteed Future Value (after 3 years): £15,000

- Difference: £15,000 (plus interest) spread over the term of the agreement

Your monthly payments cover the depreciation of the car (the difference between the initial value and the GFV) plus interest, rather than the full value of the car. This often results in lower monthly payments compared to other finance options like Hire Purchase (HP).

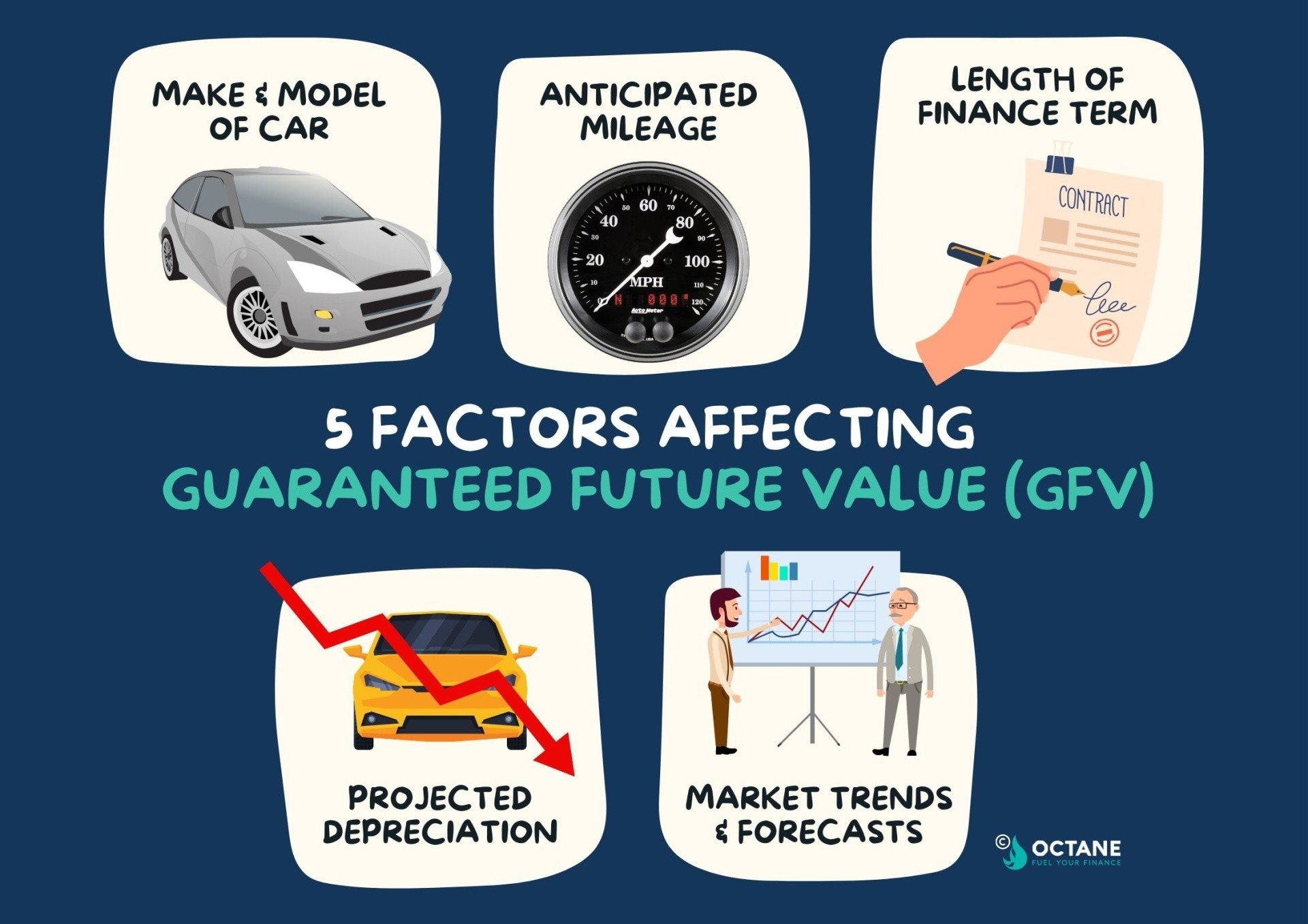

Factors Affecting GFV

Several factors influence the Guaranteed Future Value set by finance companies, these are:

- Make and model of the car

- Anticipated mileage during the agreement

- Length of the finance term

- Projected depreciation rate

- Market trends and forecasts

Finance companies, like the ones we work with, use sophisticated algorithms and market data to predict how much a car will be worth at the end of the agreement before determining a GFV.

Options at the End of the Finance Agreement

When your PCP agreement ends, the GFV comes into play, giving you three main options:

- Buy the car by paying the GFV (balloon payment) to own the car outright.

- Return the car by handing it back to the finance company with nothing more to pay (subject to mileage and condition terms).

- Trade it in and start a new agreement using any equity (if the car is worth more than the GFV) as a deposit on a new car.

Advantages and Disadvantages of GFV

So you can fully understand the risks and benefits of car finance and how Guaranteed Future Value plays its part, we’ve listed the pros and cons of GFV in the table below:

| Advantages of GFV | Disadvantages of GFV |

| Lower monthly payments because you're only financing the car’s depreciation | Exceeding the agreed mileage during the term can result in additional charges |

| Multiple options at the end of the agreement provide you with flexibility | The car must be returned in good condition to avoid extra fees |

| Protect yourself against depreciation by handing the car back at the end of the term if it’s worth less than the GFV | You don't own the car unless you make the final payment |

| If you want to end the agreement early, you might owe more than the car is actually worth |

Conclusion

Guaranteed Future Value is a key part of PCP car finance agreements. It offers flexibility and potentially lower monthly payments, but it's important to understand how it works and what it means for your long-term car ownership plans. By considering your driving habits, financial situation, and future needs, you can determine whether a finance agreement with GFV is the right choice for you.

Frequently Asked Questions About GFV

As a broker operating within vehicle finance, we naturally get asked about Guaranteed Future Value and how it works. To help in your own research, we answer the most common questions we get asked about GFV in relation to car finance:

Is the Guaranteed Future Value the same as the car's actual value at the end of the agreement?

Not necessarily. The GFV is a prediction made at the start of the agreement. The car's actual value could be higher or lower, depending on market conditions and how well the car has been maintained.

What happens if I exceed the mileage limit in my PCP agreement?

If you exceed the agreed mileage, you'll typically have to pay an excess mileage charge. This is usually calculated on a pence-per-mile basis and can be substantial if you've significantly exceeded the pre-agreed limit.

Can I negotiate the Guaranteed Future Value?

The GFV is set by the finance company and is generally not negotiable. However, it may be possible to negotiate other aspects of the deal, such as the initial price of the car or the interest rate.

What if I want to end my PCP agreement early?

Ending a PCP agreement early can be complicated and potentially expensive. You may have to pay a settlement figure, which could be more than the car is worth at that time. Always check the terms of your agreement and consult with the finance company first.

Is a finance agreement with GFV the same as leasing?

While there are similarities, they're not the same. With a lease, you never have the option to own the car. With a PCP agreement (which uses GFV), you have the option to buy the car at the end of the term by paying the final balloon payment.

How long does GFV last?

The GFV lasts for the duration of your PCP agreement, which is typically between 24 to 48 months. At the end of this period, you can choose to pay the GFV to keep the car, return the car, or use any equity as a deposit on a new agreement.

Is a higher or lower GFV better?

It depends on your circumstances: A higher GFV means lower monthly payments during the agreement, but a larger final payment if you want to keep the car. A lower GFV means higher monthly payments, but a smaller final payment. The best option depends on your budget and long-term plans for the car.

What happens if my car is worth more than the GFV?

If your car is worth more than the GFV at the end of the agreement, you have equity. You can use this equity as a deposit on a new car, or you can buy the car for the GFV and potentially sell it for a profit.

How does GFV affect mileage limits?

The GFV is partly based on the agreed mileage limit. Higher mileage limits will result in a lower GFV because the car is expected to depreciate more. Exceeding the mileage limit can result in additional charges if you return the car, as it will be worth less than the predicted GFV.

How does GFV affect my monthly repayments?

A higher GFV generally results in lower monthly repayments because you're essentially borrowing less money over the term of the agreement. You're paying off the difference between the car's initial value and the GFV, rather than the entire value of the car.

Does GFV protect me from depreciation?

To some extent, yes. If you choose to return the car at the end of the agreement and its market value has fallen below the GFV, you're protected from this additional depreciation. However, if you choose to buy the car, you'll pay the GFV regardless of its actual market value at that time.

Expert Car Finance Solutions with Octane Finance

At Octane Finance, we specialise in providing tailored car finance solutions for customers all over the UK. Our team of experts understands the intricacies of Guaranteed Future Value and can guide you through the process of choosing the right finance option for your needs.

Whether you're considering a PCP agreement or exploring other car finance options, we're here to help you make an informed decision. With our extensive knowledge of the automotive finance market alongside our commitment to customer satisfaction, you can trust us to drive you towards your perfect car finance solution.

Contact us today to discover how we can help you get behind the wheel of your dream car with a finance package that suits your budget and lifestyle.